By Jake Osborne | Credit Sense

It’s Not Just Friction—It’s Lost Revenue

You’ve built a marketing engine. Your pipeline is full. But there’s a leak in your funnel you might be overlooking.

Your bank statement connectivity is costing you money.

In a world where digital lending moves at lightning speed, delays and failures in retrieving customer bank data can quietly destroy conversion rates, burn time for your onboarding team, and increase abandonment.

And if you think this is “just a tech problem,” think again—it’s a bottom-line issue.

The Hidden Ways Poor Connectivity Costs You

1. Drop-Off at the Most Critical Stage

Every time a customer is asked to manually upload PDF statements—or gets sent to a clunky third-party site—they’re more likely to drop out of your funnel. Even a 10% drop-off at this stage can reduce your funded volume dramatically.

2. Increased Time to Decision

If your bank statement data is delayed or unreliable, assessors are left waiting—or chasing documents manually. That lag increases decision times and frustrates both brokers and borrowers.

3. Manual Verification & Follow Up

If you incur poor connectivity issues, typically the problem sits with your credit team who are unable to get a hold of frustrated customers who are unwilling to manually supply bank statements or documentation.

The Cost in Numbers

Let’s say you generate 10,000 applications a month.

- If 20% abandon due to poor bank connectivity = 2,000 lost leads

- If even 10% of those would have converted = 200 funded loans

- If your average loan profit is $800 = $160,000 lost revenue per month

And that’s not counting operational costs, loss of future credit opportunities or brand damage due to customer frustration that they hold you accountable for.

What’s the Fix? Bank Data That Just Works

At Credit Sense, we’ve built a robust, lender-grade bank statement platform designed for maximum reliability and conversion. We have been supporting over 100 lenders for over a decade, so we pride ourselves on being able to get this right.

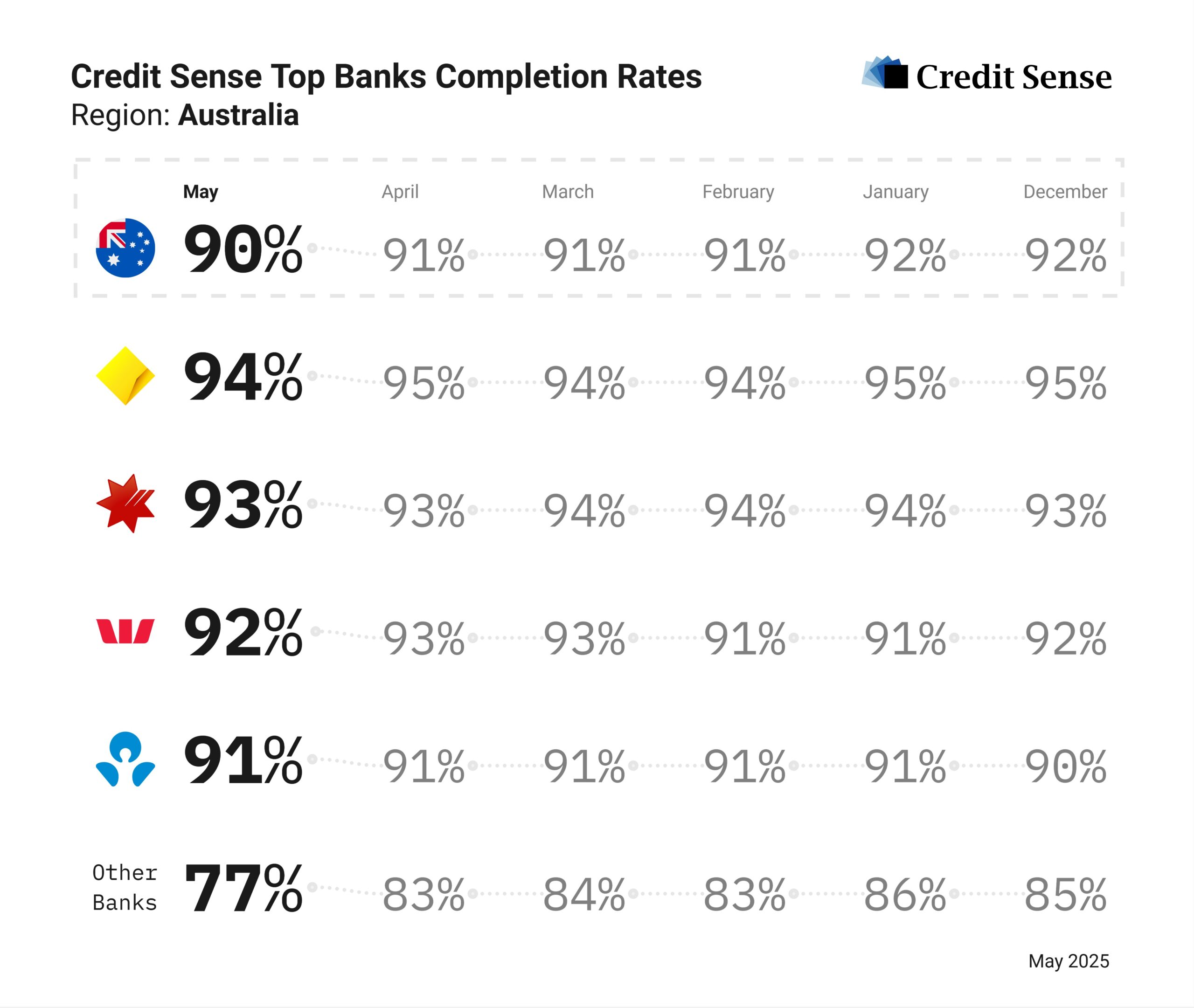

1. Industry-Leading Bank Connectivity

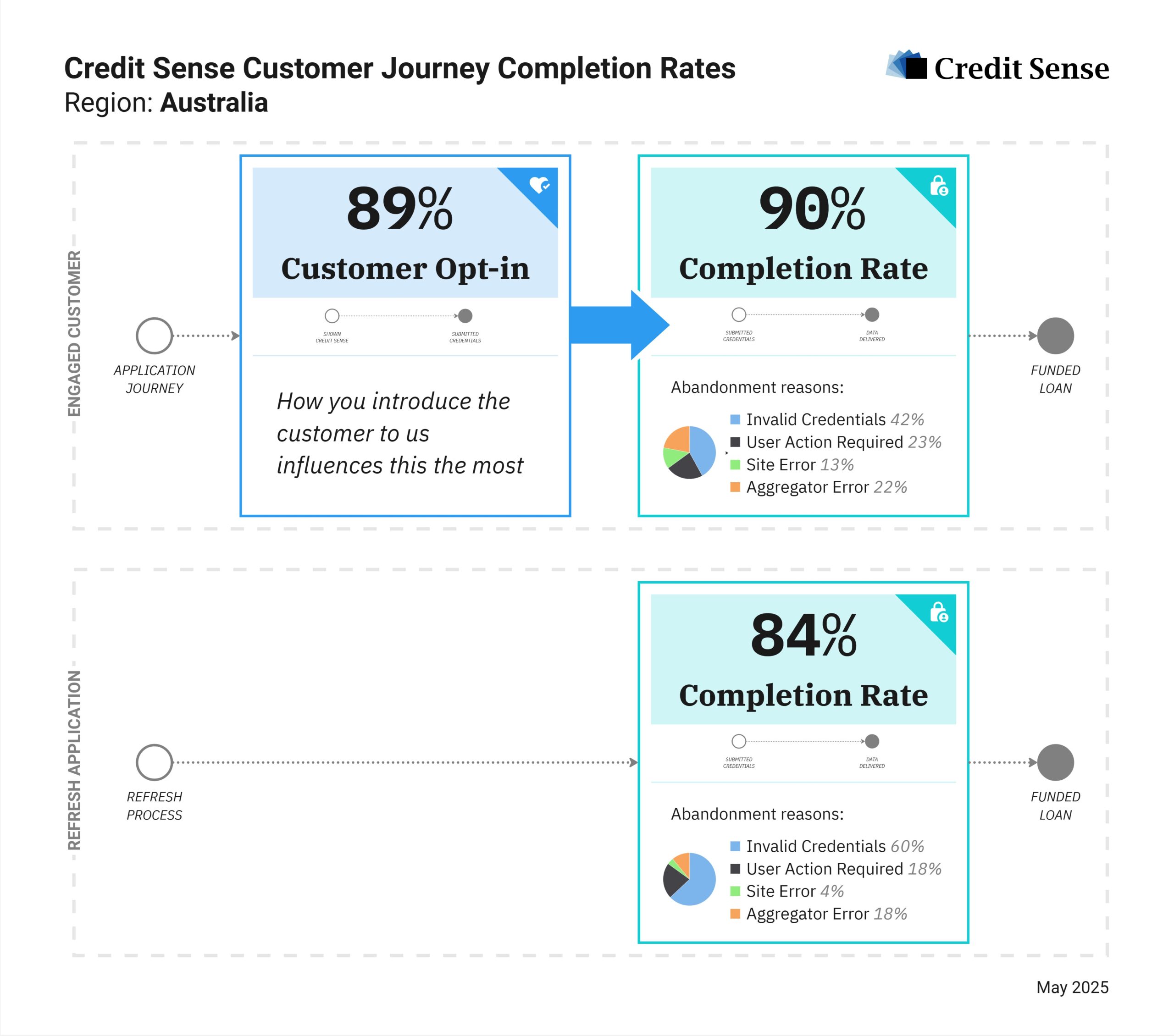

We have innovative back end solutions that ensure we maintain the highest industry standard for connectivity. Our platform connects at ~91% and helps our customers to drive greater revenue outcomes because of it.

2. Fast, Frictionless User Experience

Our interface is clean, fast, and API-first —built to help users complete the process on the first try. Note that this drives an optimal conversion rate and is key to ensuring the minimisation of drop off.

3. Real-Time, Structured Data

Statements aren’t just pulled—they’re categorised, verified, and ready for instant decisioning. That’s time saved and risk reduced. We support both manual credit assessment and auto decisioning via our sophisticated API.

4. Deep Integration & Support

Credit Sense integrates easily into your lending flow—whether you’re running a low-doc application journey or complex multi-product funnel. Our team helps ensure maximum uptime and fast implementation.

Why Is Our Completion Rate So High?

- Customer Experience Focus: We prioritize an easy, modern customer journey to ensure the highest completion rates.

- Multibank Integration: Need multiple bank statements? Our multibank feature lets customers provide them in a single journey.

- Consumer Dashboard: Customers can manage their consent with automatic online access, simplifying the process.

- MyGov Data Integration: Need more than just bank statements? We’ve made it easy to share myGov data within the journey.

- Real-time Alerts: Receive live updates, SMS, and email notifications if banks are down for maintenance or offline.

- Continuous Improvement: All features are designed to maximize comfort, reduce friction, and improve completion rates for your customer.

The Bottom Line

If you’re spending money to bring in leads, but losing them at the document collection stage, your tech stack is costing you more than you think.

Fast, reliable, and structured access to bank statement data isn’t a “nice-to-have”—it’s a profit multiplier. And it’s one of the easiest wins you can get in lending operations.

Ready to stop losing deals to broken bank statement workflows?

Talk to Credit Sense today and let’s plug the leak in your funnel—for good.

Reach out to [email protected] or [email protected] to find out how Credit Sense can help drive greater conversion rates for your business.