The growing problem of poor quality finance leads and what to do about it…

By Jake Osborne | Credit Sense The Problem No One Talks About: Lead Quality You’ve invested heavily in paid media. Your cost per lead looks reasonable. The volume is flowing. But there’s a nagging issue: your leads just aren’t converting. This is one of the most common—and costly—problems facing Australian lenders, brokers, and fintechs today….

How Bank Statement Connectivity Issues Are Quietly Costing Your Lending Business

By Jake Osborne | Credit Sense It’s Not Just Friction—It’s Lost Revenue You’ve built a marketing engine. Your pipeline is full. But there’s a leak in your funnel you might be overlooking. Your bank statement connectivity is costing you money. In a world where digital lending moves at lightning speed, delays and failures in retrieving…

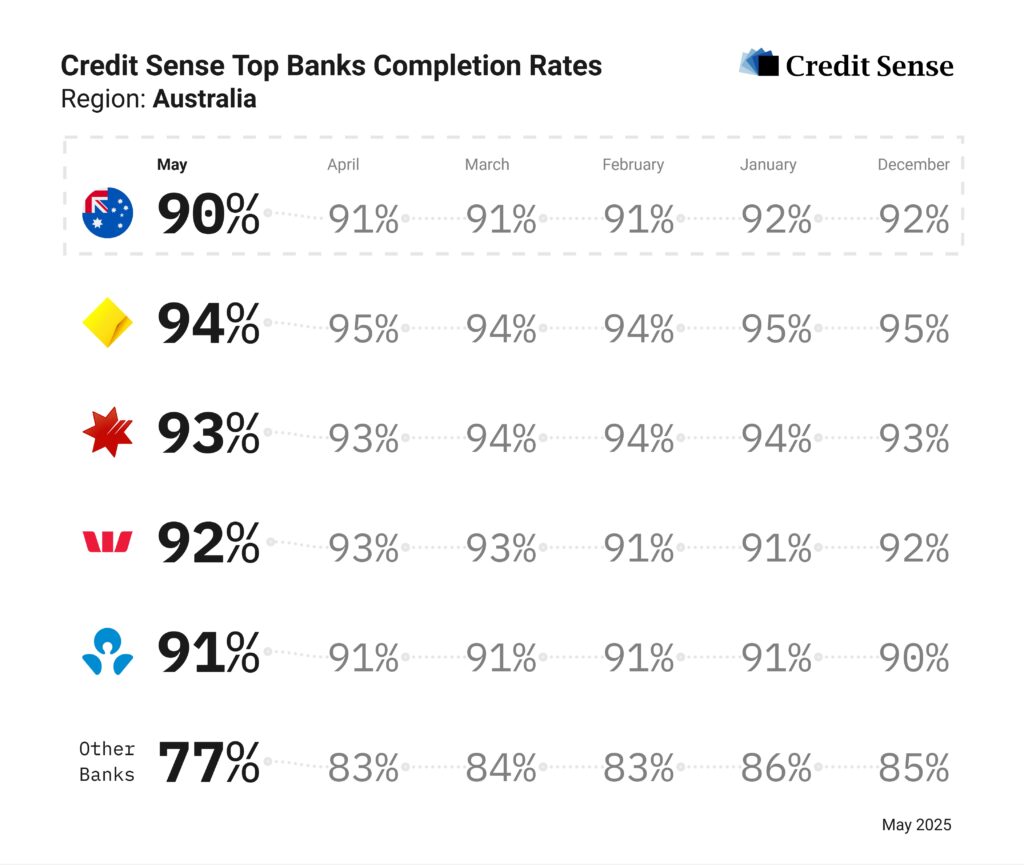

What is completion rate – and what should you expect?

Completion rate in our context is the number of people who complete the Credit Sense customer journey, divided by the number of people who were presented with it. For example, if 100 people are presented with our customer journey, and 10 of them don’t complete it (for any reason), that’s a 90% completion rate. …