Privacy, security & compliance

We are certified to the ISO/IEC 27001:2022 standard for information security management and follow leading industry practice for compliance and privacy.

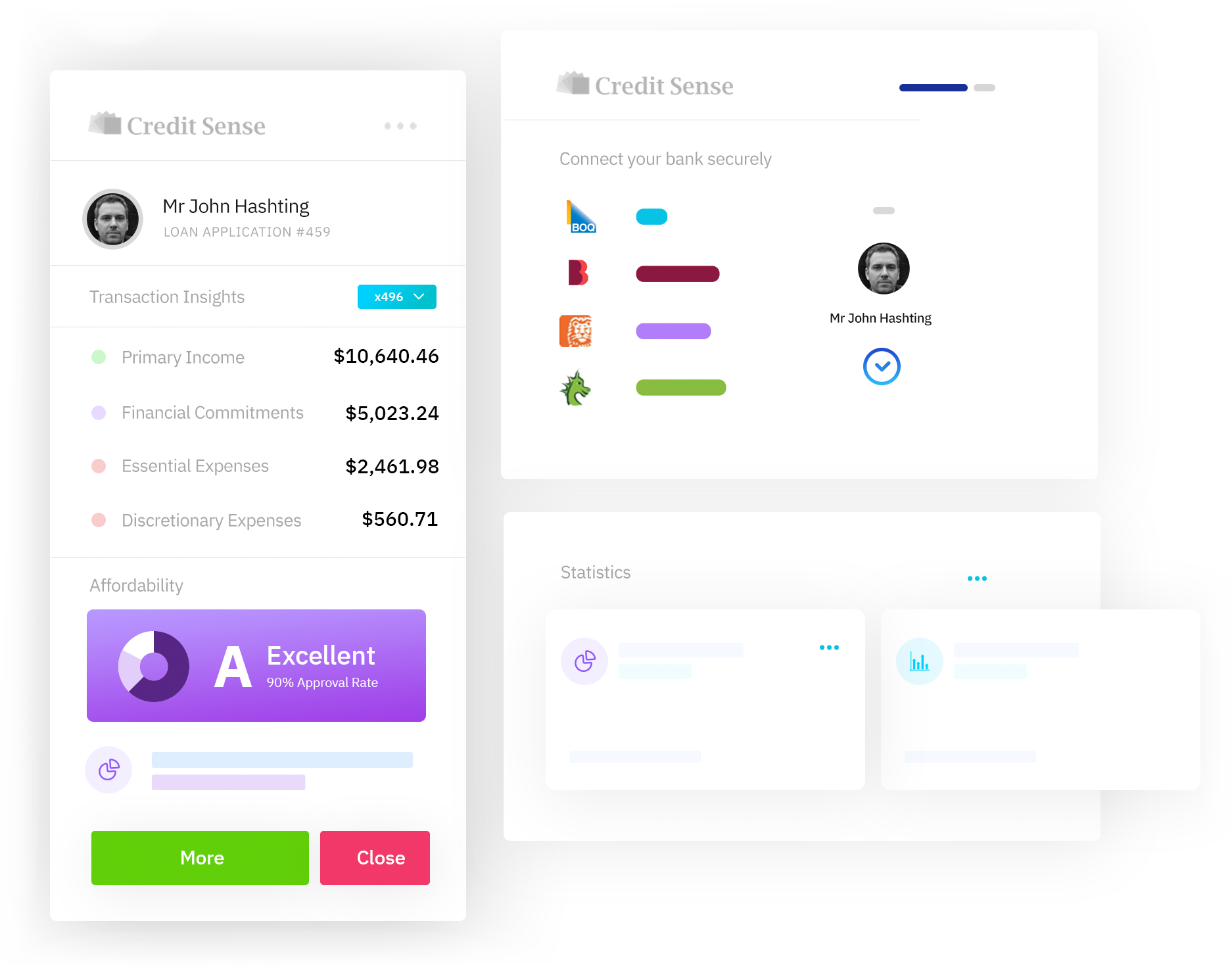

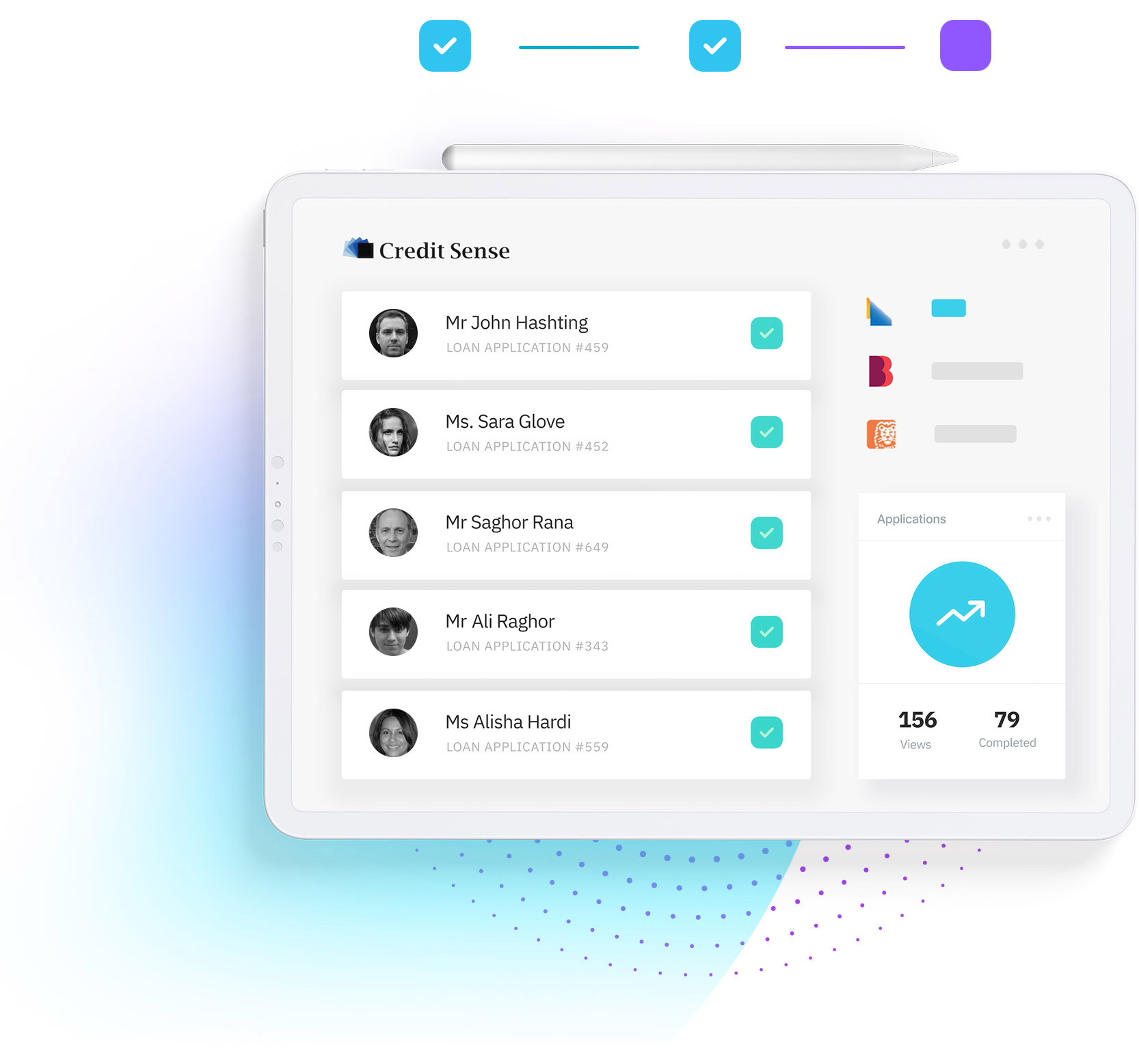

Credit Sense obtains your customer’s transaction history and supporting documents in a secure, consent driven journey, delivering you key income and affordability insights so you can make fast and informed decisions.

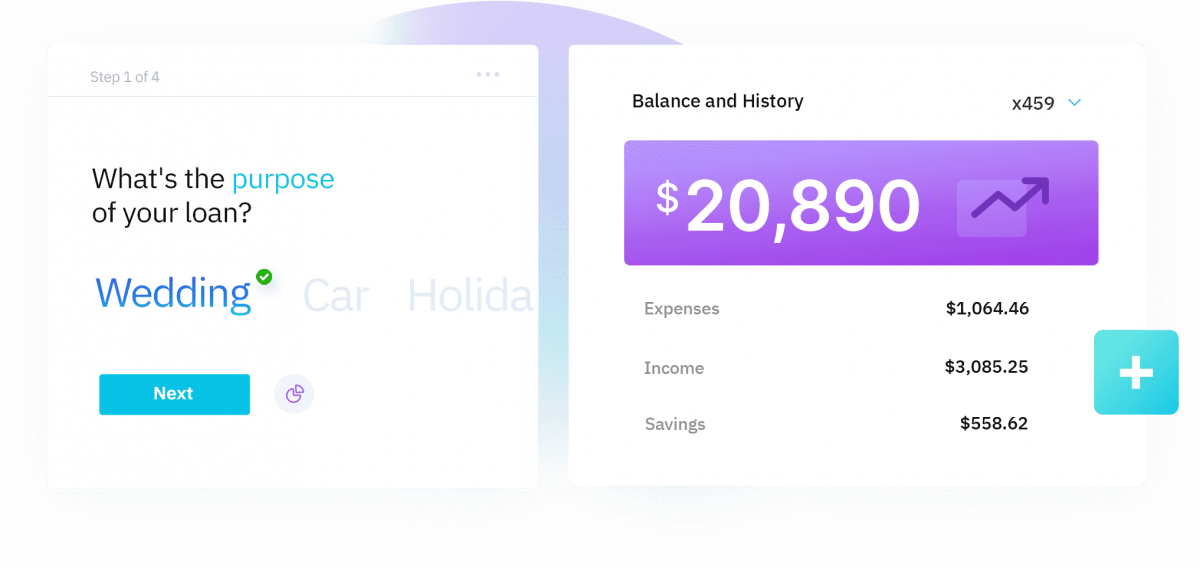

As a lender, you need reliable income and affordability insights to meet risk and compliance obligations – but you also need to deliver the fast and enjoyable experience customers expect. The problem is that obtaining reliable documentation and assessing income and affordability can be slow, expensive and frustrating for customers.

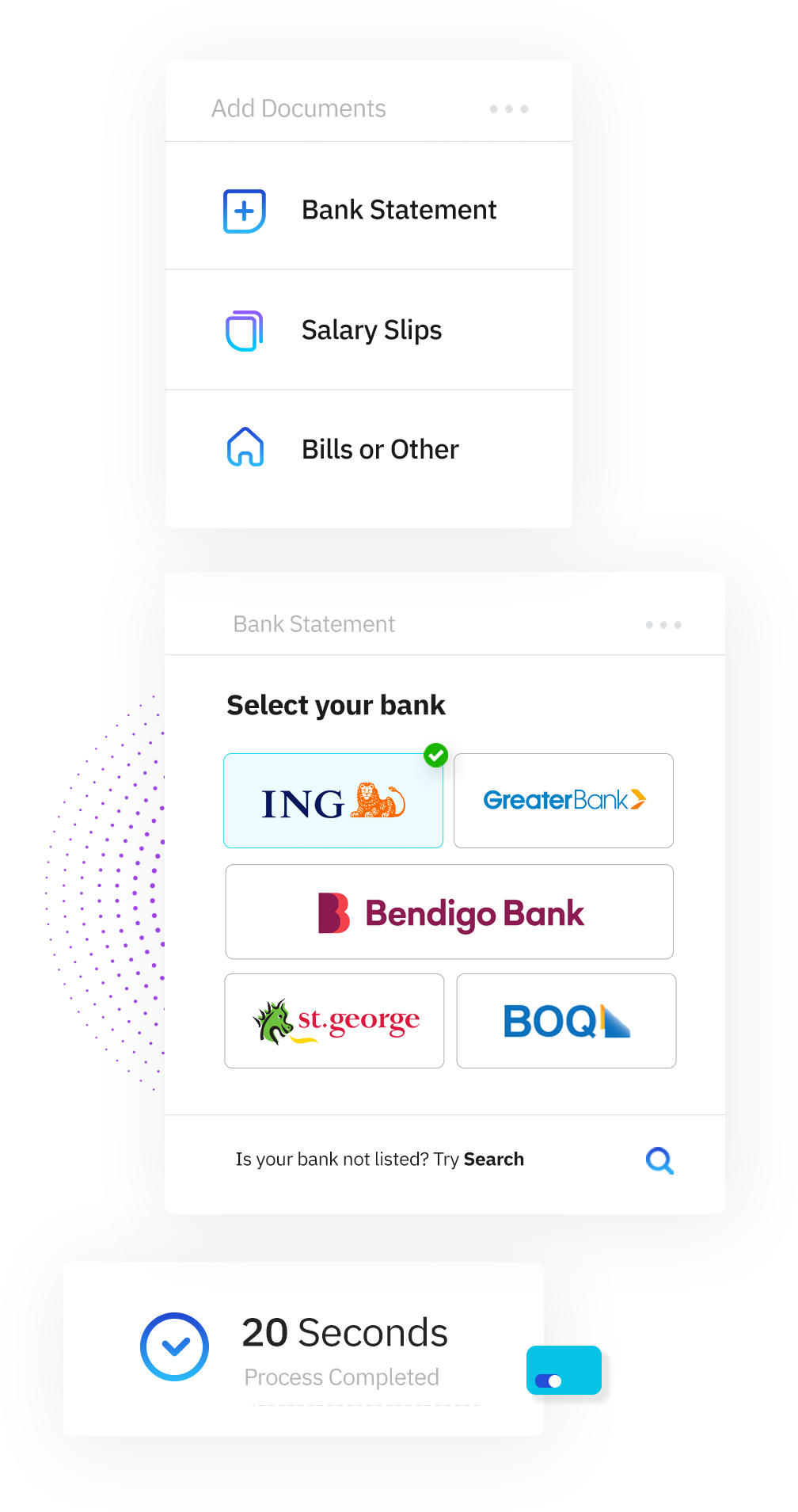

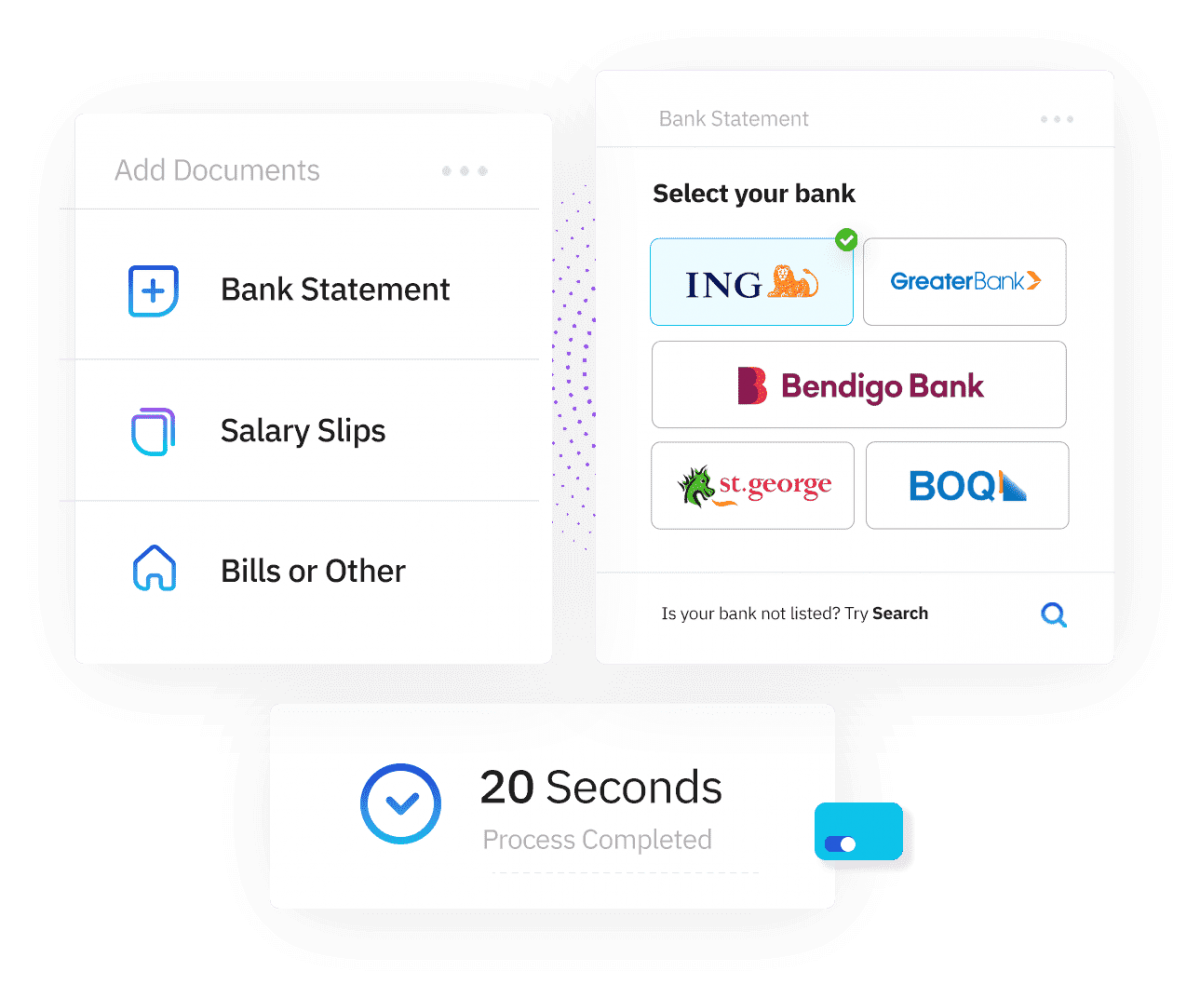

Credit Sense enables customers to supply bank statements and supporting documents as part of your application process in a secure, beautiful customer journey – that can take as little as 20 seconds. You’ll make more accurate, consistent decisions and give customers an outcome in less time than ever before.

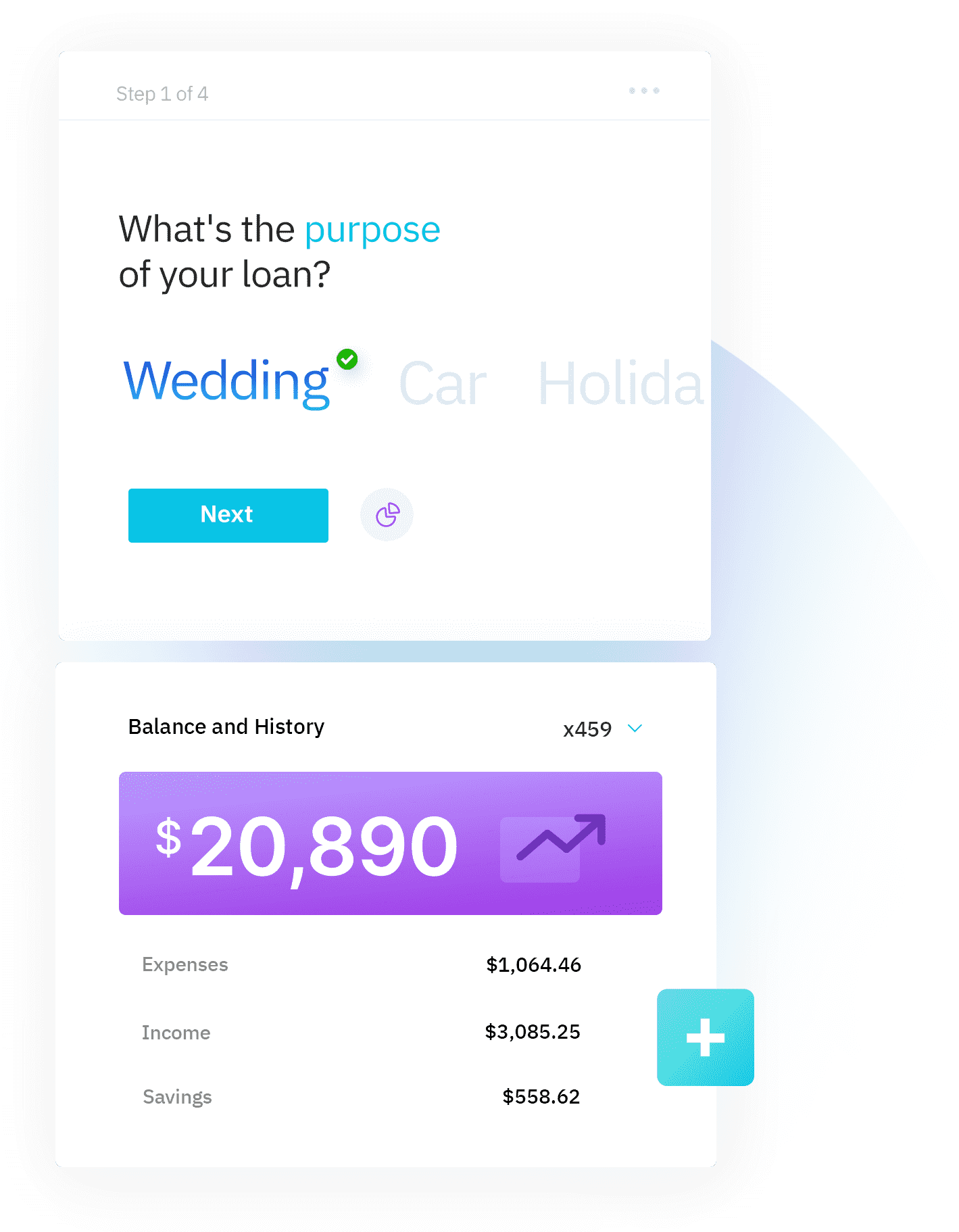

Every lender wants to give customers an easy and enjoyable experience when applying for a loan. Unfortunately for customers, the thought of detailing their budget and supplying their transaction history can be stressful and frustrating.

Credit Sense’s customer journey is secure, fast and enjoyable to use. We securely gather the data, analyse it and provide consistent and reliable income and affordability insights to speed up your assessment process. Credit Sense delights customers and makes applying for a loan fast, easy and memorable.

The moment a customer begins a loan application through your website, you have already done the hard work. But with every interaction, every second of wait time, every document they have to upload, their experience deteriorates. This is especially true when they need to provide bank statements and complete a complicated budget.

Credit Sense simplifies this difficult process for the customer, reducing the risk of abandonment while providing the easiest and fastest experience on the market. This means you can make faster decisions and take customers off the market sooner, all while giving your customers an experience they will want to share with their friends.

Obtain Customer Transaction History Fast

Automate and obtain reliable customer income and affordability insights in a fraction of the time it normally takes – making it easy to give your customers the seamless experience they deserve!

Improve Your Completion And Conversion Rate

Credit Sense can deliver a simple, frictionless process customers love – so you can get an answer to your customers and take them off the market faster than ever before!

A Secure and Safe Process

Keeping your data safe is our priority. All data is encrypted at rest and in transit, and stored in isolated and highly secure vaults using 256-bit AES row-level encryption accessible only via restricted access networks. We utilise behavioural analytics and anomaly detection algorithms that continuously scan all activity across our network in addition to continuous infrastructure monitoring by our SecOps. Your customers will enjoy safety and security from start to finish.

Manage Risk With Better Insights

With deeper and more reliable income, affordability and risk insights, you can make faster and more consistent decisions and reduce your compliance and general business risks.

Credit Sense offers the most advanced bank transaction data insights on the market. Choose from over 500 custom financial insights to help you manage risk in your assessment process. If you need something special, our Technical Account Managers are here to help you design your own with our custom insights tool.

Our financial data insights can improve consistency and help you manage your responsible lending obligations with confidence.

Credit Sense is a powerful, easy-to-integrate platform that will work seamlessly with your existing software. We offer a one-line of code integration option making the process as straightforward as possible to get you up and running fast.

You’ll also have a dedicated Technical Account Manager working with you to understand your business needs and ensure you get the most value from our platform. Your success is important to us, so you can expect the highest level of ongoing support as your business grows, ensuring our solution evolves with your business needs and continues to deliver unmatched value.

Easy integration

<iframe id="creditSenseIFrame" src="about:blank" style="height: 580px; width:98%; border: none">iframes are not supported in this browser</iframe>

<script src="https://static.creditsense.com.au/CS-Integrated-Iframe-v1.min.js"></script>

<script>

document.addEventListener("DOMContentLoaded", function(event) {

// Your code to run after DOM is loaded and ready

$.CreditSense.Iframe({

client: "DEMO",

elementSelector: "#creditSenseIFrame",

enableDynamicHeight: true

});

});

</script>

Custom insights allow you to automate key parts of your process with the most consistent and reliable transaction analysis available. You can achieve more consistent outcomes, reduce mistakes and improve job satisfaction by allowing your credit analysts to apply their focus where it’s truly valuable.

Custom insights provide key metrics such as customer income, essential and discretionary expenses, outlying spend events, affordability and risk. Using custom insights can lower your compliance costs and help to ensure your bank transaction assessment processes are being consistently applied.

Commercial and consumer lending have different challenges. We recognise that assessing a business is not the same as assessing a consumer and have specialised analysis products for commercial lending applications.

Credit Sense Commercial delivers a view of business’ bank transactions that align with the cashflow and business trading insights commercial lenders need.

Get access to specialised commercial bank transaction analysis and transform the speed and consistency of your commercial credit assessment process.

Obtain commercial bank transaction data fast with one of our data capture options

Consistent view of revenue types, fixed and variable expenses and other business activity

Manages for commercial and consumer co-mingled bank transactions

Use custom insights to consistently apply your specific credit assessment rules

As a developer, you want to ensure any new software your business uses will meet your technical specifications and perform at a level that makes the investment worthwhile. We offer a configurable one-line integration, making the process as simple as possible.

Our flexible infrastructure and reliable systems ensure your customers always have a smooth, user-friendly experience. Designed to work seamlessly with your existing software, Credit Sense will integrate effortlessly into your business and streamline your loan application process.

Our goal is to improve how the world shares data. We want consumers and businesses to be able to connect and share information, safely and easily. This way, they can work together to build stronger relationships that deliver mutual benefits far beyond a single transaction.

With Credit Sense, consumers retain visibility and control of their consents – while businesses access reliable and useful financial insights to serve their customers better and faster. This means a more enjoyable application process for everyone involved.

Are you a rising star, veteran or a heavy hitter with a proven history of wins in software development, data science, business development, sales or marketing? Would you like to work with an exciting and innovative business? Credit Sense provides excellent employee benefits, an amazing and supportive workplace and multiple opportunities to grow your career.

Work with a team who are excited about the future. Click the link below to find out more about our company and what we stand for, our current opportunities and how you can join our team.

As industry leaders, we do what no other provider can do. We’re so confident we can reduce your online loan application bank statement abandonment by 20% in the first 30 days, that if we don’t, our Technical Account Managers will work with you for free until we do.

You’ll be assigned a dedicated Technical Account Manager to help reduce your bank statement abandonment so you increase your overall completion rate. We’ll work together to provide dedicated strategies and tactics to get more applications flowing through.* *T&C’s Apply

Here’s what we’ll go over during your free demo:

The simple way to increase the speed of your online loan application process and improve your completion rates

How you can use Credit Sense to automate your loan application workflows while ensuring you manage your compliance obligations and meet your risk management goals

How you can solve income identification and affordability assessment for your business using Credit Sense

How to use Credit Sense to provide fantastic support to applicants who do not fit your target market and unlock an additional revenue stream

The ‘Plug and Play’ integration model that makes it simple, easy and effective to integrate into any online system

Plus, you’ll be able to ask any technical and process related questions regarding Credit Sense and how it will work in your business

Fill out the form below and we will contact you shortly to organise your free product demo.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.